CMA CGM Imposes Emergency Operational Recovery Surcharge on Pakistan Trade Lanes – Effective May 15, 2025

Introduction:

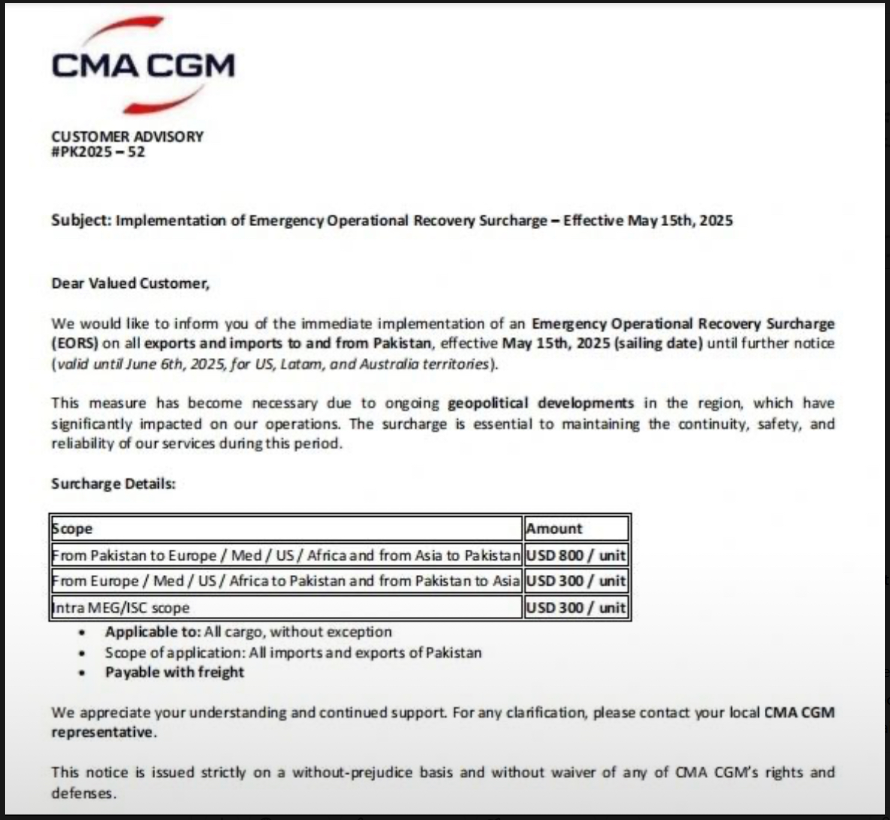

In a significant development for regional shippers and logistics managers, CMA CGM has announced the implementation of an Emergency Operational Recovery Surcharge (EORS) on all exports and imports to and from Pakistan, effective May 15, 2025. This surcharge is applicable across all cargo types and aims to address the rising operational challenges due to ongoing geopolitical developments in the region.

The decision comes amid increasing tensions and disruptions in the South Asian logistics corridor, particularly affecting the continuity and cost structure of global shipping lines operating in and out of Pakistan. Here’s a detailed analysis of the announcement and its implications for Indian exporters and logistics professionals.

Why Has the Surcharge Been Implemented?

CMA CGM has cited “geopolitical developments” in the region as the main reason for this surcharge. Though not explicitly detailed in the advisory, such developments may include increased security risks, disrupted port operations, and rising insurance or operational costs in and around Pakistan.

To maintain the safety, continuity, and reliability of its services, the shipping giant has deemed it necessary to recover part of these unforeseen expenses through the surcharge mechanism.

Surcharge Structure and Scope

The EORS is applicable as follows:

| Scope | Amount |

|---|---|

| From Pakistan to Europe / Mediterranean / US / Africa and from Asia to Pakistan | USD 800 per unit |

| From Europe / Mediterranean / US / Africa to Pakistan and from Pakistan to Asia | USD 300 per unit |

| Intra Middle East Gulf (MEG) / Indian Subcontinent (ISC) | USD 300 per unit |

Key Points:

- Effective Date: May 15, 2025 (Sailing Date)

- Duration: Until further notice (Valid until June 6, 2025, for US, LATAM, and Australia territories)

- Applicability: All cargo, without exception

- Payment Terms: Payable with freight

- Scope: All imports and exports of Pakistan, across full container load (FCL) and potentially other cargo types

Impact on Exporters and Importers in the Region

While the surcharge directly affects those trading with Pakistan, Indian exporters operating in joint corridors or via transshipment through Pakistani ports may also experience indirect cost escalations or supply chain delays.

The USD 800/unit surcharge on major lanes like Pakistan–Europe or Pakistan–US will likely cause price competitiveness issues for exporters and increase overall logistics budgets. It also puts pressure on freight forwarders and NVOCCs (Non-Vessel Operating Common Carriers) to revise client quotations urgently.

Implications for Indian Exporters:

- Higher Regional Shipping Costs: If your logistics chain includes transshipment via Karachi or other Pakistani ports, your freight rates may be revised.

- Capacity Shifts: With carriers possibly redirecting resources from risky routes, space availability on key lanes (especially MEG and ISC) could become tighter.

- Need for Alternative Routes: Indian exporters may consider rerouting goods directly via Indian ports to avoid surcharge-affected corridors.

- Revised Trade Quotations: It is crucial for exporters to update quotations and Incoterms with international buyers to account for the newly introduced surcharge.

What Should You Do?

If you’re an exporter, freight forwarder, or supply chain manager working in the India–Middle East–Africa or India–Pakistan–US corridors, here’s what you should consider:

- Review All Bookings with CMA CGM after May 15, 2025.

- Revise Quotes and Contracts with buyers, especially if your price includes CIF or DDP terms.

- Engage Freight Brokers to compare rates across other carriers that may not have implemented similar surcharges.

- Stay Updated with trade advisory platforms like StartExportIndia.com for real-time logistics changes.

- Communicate with Buyers about potential delays or rate escalations.

Conclusion

The imposition of the Emergency Operational Recovery Surcharge by CMA CGM marks a critical moment in South Asian shipping operations. While aimed at maintaining operational integrity, it reflects the fragile geopolitical and trade landscape in the region. Exporters, importers, and freight handlers must be proactive in reassessing their logistics plans and cost structures.

Stay informed, agile, and ready to adapt. For more updates on international trade, logistics policies, and export guides, visit StartExportIndia.com.