- Understanding International Payment Terms

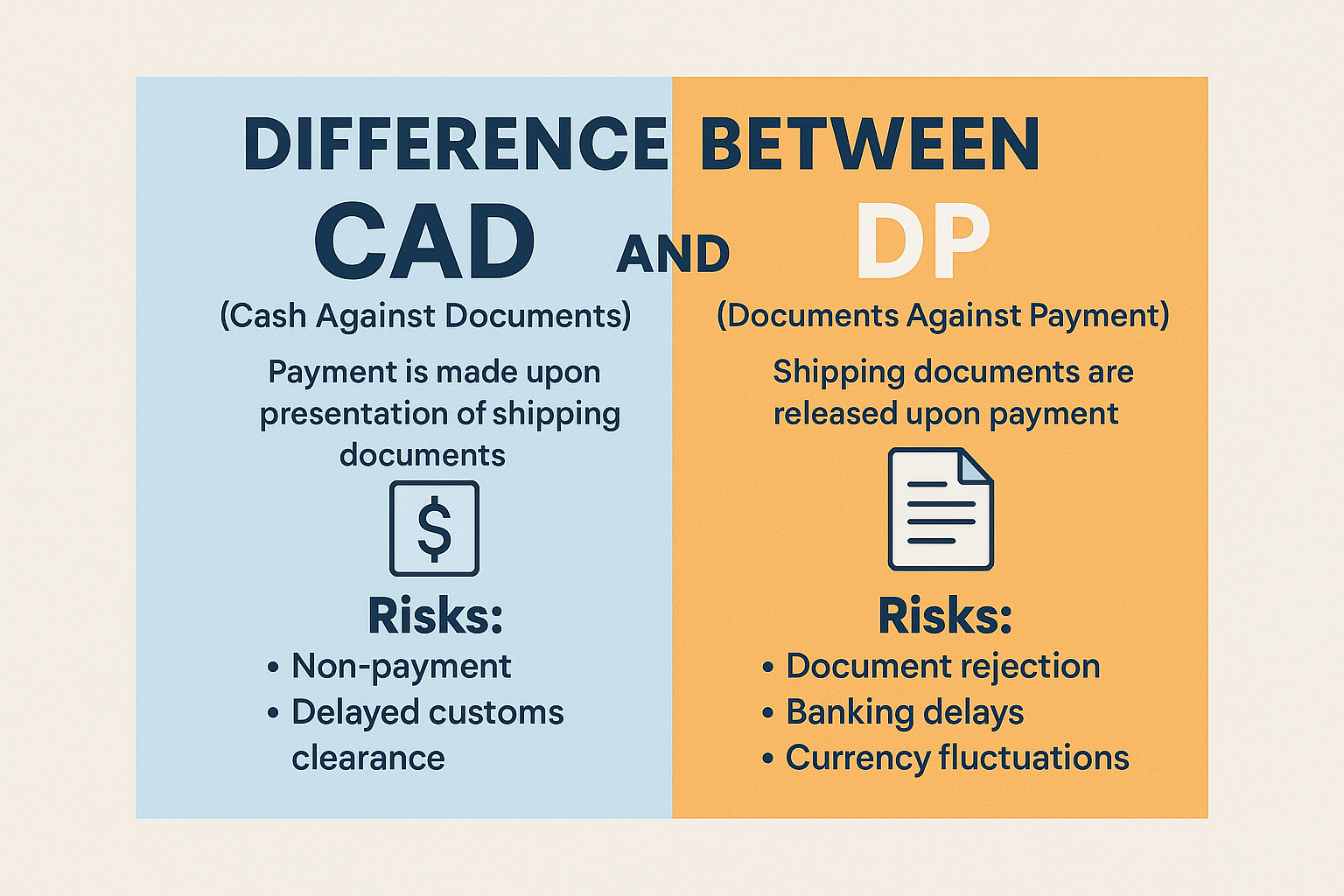

- What is CAD (Cash Against Documents)?

- What is DP (Documents Against Payment)?

- Major Differences Between CAD and DP

- Risks Involved in CAD Transactions

- Risks Involved in DP Transactions

- Risk Mitigation Strategies for Exporters

- When to Use CAD vs When to Use DP

- Legal and Compliance Considerations

- Expert Tips for Indian Exporters

- Common Mistakes to Avoid

- Final Thoughts

- FAQs About CAD and DP

Learn the difference between CAD and DP in export transactions. Discover key risks, comparisons, and strategies for Indian exporters to protect payments and goods.

Understanding International Payment Terms

In global trade, ensuring timely and secure payments is one of the biggest concerns for exporters and importers alike. Two commonly used payment terms—CAD (Cash Against Documents) and DP (Documents Against Payment)—serve this purpose but differ significantly in process and risk. Understanding these distinctions is crucial, especially for growing exporters in India navigating international markets.

What is CAD (Cash Against Documents)?

CAD refers to a trade arrangement where the exporter’s bank hands over shipping documents to the importer only after the importer makes payment. The transaction relies on trust that both parties will honor their commitments. Importers typically use this method to avoid advance payments while still securing goods.

Step-by-Step Process of CAD

- Exporter ships goods.

- Exporter sends the documents to their bank.

- The bank sends the documents to the importer’s bank.

- Importer pays the required amount.

- Importer receives the documents and clears goods from customs.

Key Parties Involved in CAD

- Exporter – Ships goods and awaits payment.

- Importer – Pays to access documents.

- Exporter’s Bank – Receives and forwards documents.

- Importer’s Bank – Collects payment and releases documents.

What is DP (Documents Against Payment)?

DP, also called Sight Draft, is another document collection method in which the exporter instructs the bank to release shipping documents to the buyer only upon payment. It may seem similar to CAD, but DP follows stricter rules and gives the seller slightly more control.

Step-by-Step Process of DP

- Exporter ships goods.

- Documents are sent to the bank with a sight draft.

- Importer’s bank presents the draft to the buyer.

- Upon payment, the bank hands over documents.

- Buyer clears the goods using these documents.

Key Parties Involved in DP

Same as CAD, but the draft acts as a formal demand for payment—providing a slightly more structured setup.

Major Differences Between CAD and DP

| Feature | CAD | DP |

|---|---|---|

| Control Over Documents | Less structured | More formal with draft |

| Payment Timing | After shipping documents are sent | Immediate upon presentation |

| Exporter’s Risk | Higher if importer delays | Slightly lower due to draft |

| Bank’s Role | Passive (document carrier) | Active (enforces draft) |

| Security for Exporter | Moderate | Higher |

Risks Involved in CAD Transactions

- Non-Payment Risk: The buyer might delay or refuse payment, leading to losses.

- Delayed Customs Clearance: Importers may not retrieve goods promptly, incurring storage charges.

- Document Errors: Miscommunication between banks can cause delays or rejections.

Risks Involved in DP Transactions

- Document Rejection: If the buyer doesn’t agree to pay upon document arrival, the goods might be stranded.

- Banking Delays: Some banks may not follow up actively, increasing risk.

- Currency Fluctuations: Payment may be delayed if the importer is affected by foreign exchange issues.

Risk Mitigation Strategies for Exporters

Using Trade Insurance and Payment Guarantees

Exporters should consider:

- Export Credit Guarantee Corporation (ECGC) coverage.

- Bank guarantees or letters of credit as fallbacks.

Pre-shipment and Post-shipment Financing

Use these financing tools to maintain liquidity while awaiting payment.

When to Use CAD vs When to Use DP

| Scenario | Preferred Term |

|---|---|

| Trusted buyer, long-term relationship | CAD |

| New buyer, unfamiliar market | DP |

| High-value transaction | DP with additional insurance |

| Bulk or low-margin goods | CAD (to reduce costs) |

Legal and Compliance Considerations

- Ensure FEMA and RBI compliance for overseas remittances.

- Consult export consultants to draft clear terms in sale contracts.

- Validate documents through an authorized dealer bank.

Expert Tips for Indian Exporters

- Always verify the buyer’s credibility.

- Use digital document tracking to reduce delays.

- Choose banks with efficient international desk services.

Common Mistakes to Avoid

- Assuming payment security just because documents are sent via bank.

- Not specifying payment terms clearly in sales contracts.

- Skipping export insurance for high-risk markets.

Final Thoughts

Understanding the difference between CAD and DP is more than a technical nuance—it’s about protecting your business from financial risk. While both are trusted payment methods, the choice depends on your trade experience, buyer reliability, and risk appetite. By combining good judgment with secure financial instruments, Indian exporters can thrive in competitive international markets.

FAQs About CAD and DP

1. Is CAD safer than DP?

No, DP is generally safer because it uses a sight draft which makes it more formal and enforceable.

2. Which method is faster for receiving payments?

DP is typically faster since payment is made immediately upon document presentation.

3. Can I change from CAD to DP mid-transaction?

It depends on both parties’ agreement and whether documents have already been processed.

4. What documents are needed for CAD and DP?

Common documents include bill of lading, invoice, packing list, and certificate of origin.

5. Are there additional bank charges?

Yes, both methods involve collection and handling charges which vary by bank and country.

6. Do these methods apply to all countries?

Yes, but acceptance may vary depending on trade regulations and buyer practices in specific countries.